Every year, PLAS meets with pre-law students and law school applicants to answer the question “How do I pay for law school?”

Law school can be expensive. Paying for law school will look different than paying for an undergraduate education. With the right knowledge, tools, and support you can make this process manageable and less intimidating. And PLAS is here to help.

A Note on AccessLex:

Before we take you on a journey, we highly encourage you to take advantage of a wide range of resources available to you. One of the best resources related to financing law school is AccessLex, a not-for-profit organization that specializes in helping students navigate many aspects of the law admissions process, including financing law school. Their services are completely free and are available to aspiring law students, current law students, and attorneys! You can browse their online resources or set up a meeting with a certified financial expert. Trust us, AccessLex is one of the best tools you can have in your toolbox.

Sources for Paying for Law School

Students attending undergraduate institutions for their first bachelor’s degree may have a wide variety of funding options, such as federal loans and grants, work-study programs, need-based scholarships, and merit-based awards. However, the options for law school may be more limited to options during your undergraduate experience. Those sources are:

Merit-Based Scholarships

The main source of scholarships for law school are merit-based, with a significant focus on the applicant’s GPA and LSAT scores to determine an award amount. As a result, it is important to consider schools where your LSAT and GPA will be competitive to maximize your chances of receiving a scholarship, particularly if minimizing law school debt is a high priority goal. Generally speaking, need-based scholarship options are much more limited for law school. Law schools may have other types of scholarships available through the admissions process focused on additional applicant critieria, however, most law schools do not give need-based scholarships or provide more limited need-based options.

Note: What is considered “competitive” will vary from school to school. You are welcome to schedule an appointment with an advisor to talk through your options.

Federal Loans

There are two types of federal loans available for law school: 1) Federal Direct Unsubsidized Loans and 2) Grad PLUS Loans. You must fill out a FAFSA to see if you qualify for these options. To learn more about these options please visit the Federal Student Aid webpages linked above. Keep in mind that law school applicants are considered independent for purposes of determining financial aid eligibility.

The FAFSA

Any student who wants to be considered for federal, state, and school financial aid programs must fill out the FAFSA. The 2024-2025 FAFSA is going to look different than last year’s application. We encourage all rising law students to fill out the FAFSA the spring before you start law school.

Here are some notable changes that relate to future law students:

- Rising law students can add up to 20 schools to their FAFSA.

- The Student Aid Index (SAI) has replaced the Expected Family Contribution (EFC)

- The new form is now available in the 11 most common languages in the USA.

- Students can expect to see fewer questions on the form.

The University of Illinois Office of Financial Aid provides helpful guidance on the FAFSA and changes for the 2024-2025 aid year. You can also check out the helpful video below.

SIDEBAR: Independent v. Dependent Status

One of the biggest differences between undergraduate and law school (or any graduate program) is that you are considered financially independent for purposes of determining federal aid eligibility. This means that you are not required to submit parental information when applying for federal aid for law school. Please note that some law schools may ask to receive parental information, be sure to check with your list of schools to confirm in advance.

Private Loans

Private loans are another source of funding. The ability to obtain a private loan will depend on many factors, including your credit history and the possible need for a co-signor. Interest rates, as well as, repayment requirements for private loans vary. It is important to understand the terms before taking on a private loan. Additionally, you should always try to borrow federal loans first (if available) and only borrow what you need.

Independent Funds

Law students may be able to fund their education through sources other than those listed above. This is where you can get creative! Here is a list of potential sources of independent funds:

- Work-Study/Graduate Assistant/Teaching Assistant: some law schools may provide students with an opportunity to earn money or receive tuition remission through work-study, serving as a graduate or teaching assistant, or something similar.

- External Scholarships: There are many scholarships available to current and prospective law students through independent organizations. AccessLex manages a robust scholarship databank listing these options. Keep in mind that scholarship offers will continue to be available to you as a current law student. Make it a habit to review available scholarships to maximize your chances of earning some!

- Veterans Educational Assistance: If you are a veteran, you may have access to educational benefits through the US Department of Veterans Affairs.

- Personal Savings or Summer Jobs: Some law students can offset the cost of their education through personal savings. Another option is to use your salary from your summer jobs during law school to offset your academic year expenses.

Regardless of how you fund law school, it will be important to understand how much law school will cost so you can plan accordingly.

Cost of Attendance

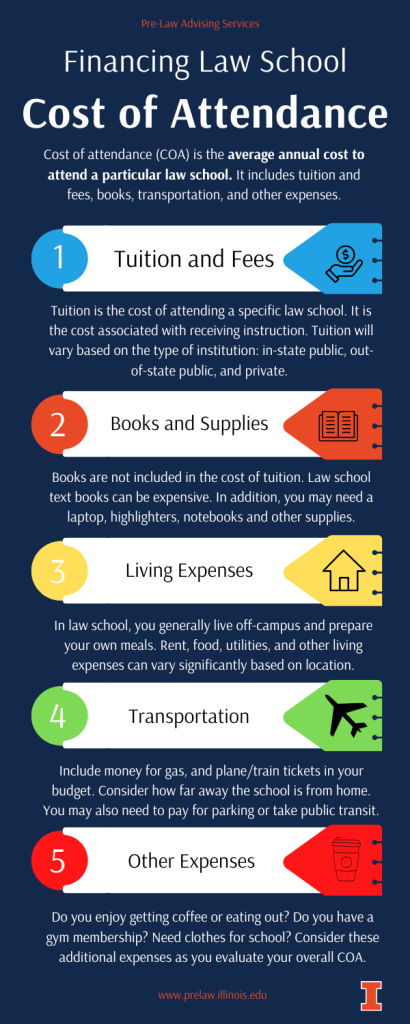

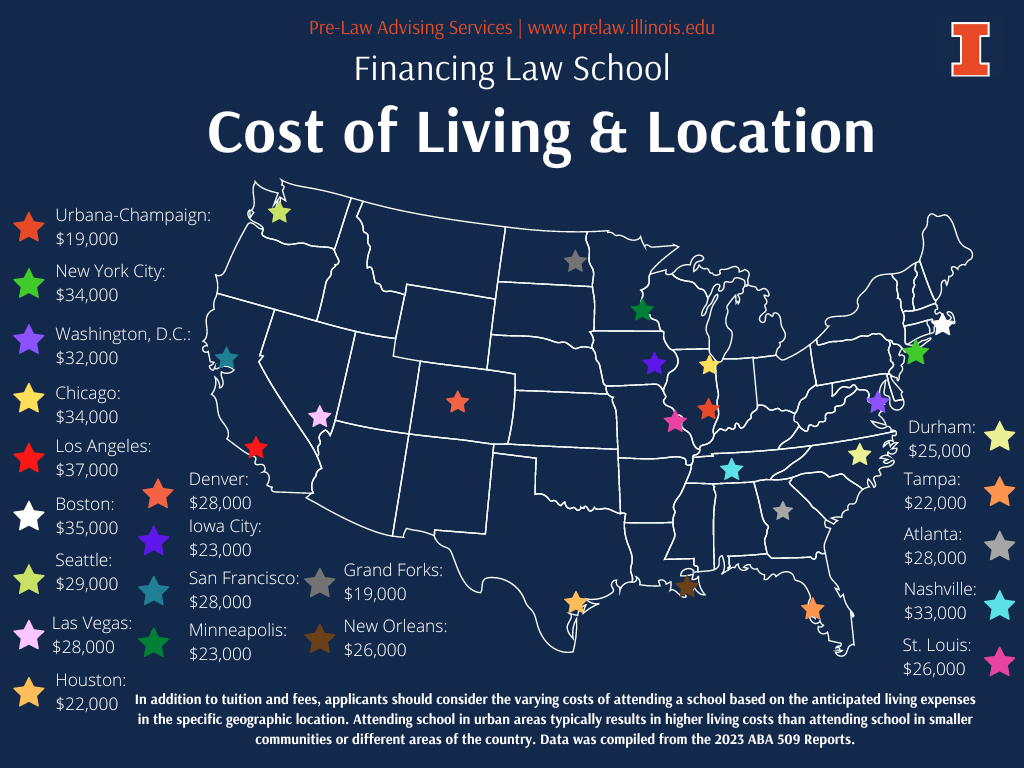

To understand how much you may need to borrow, you need to understand how much law school will cost. This is called Cost of Attendance or COA. COA includes items such as tuition and fees, books, supplies, living expenses (NYC v. Champaign?), transportation, parking, and other miscellaneous expenses. Law schools publish their unique COA on their websites.

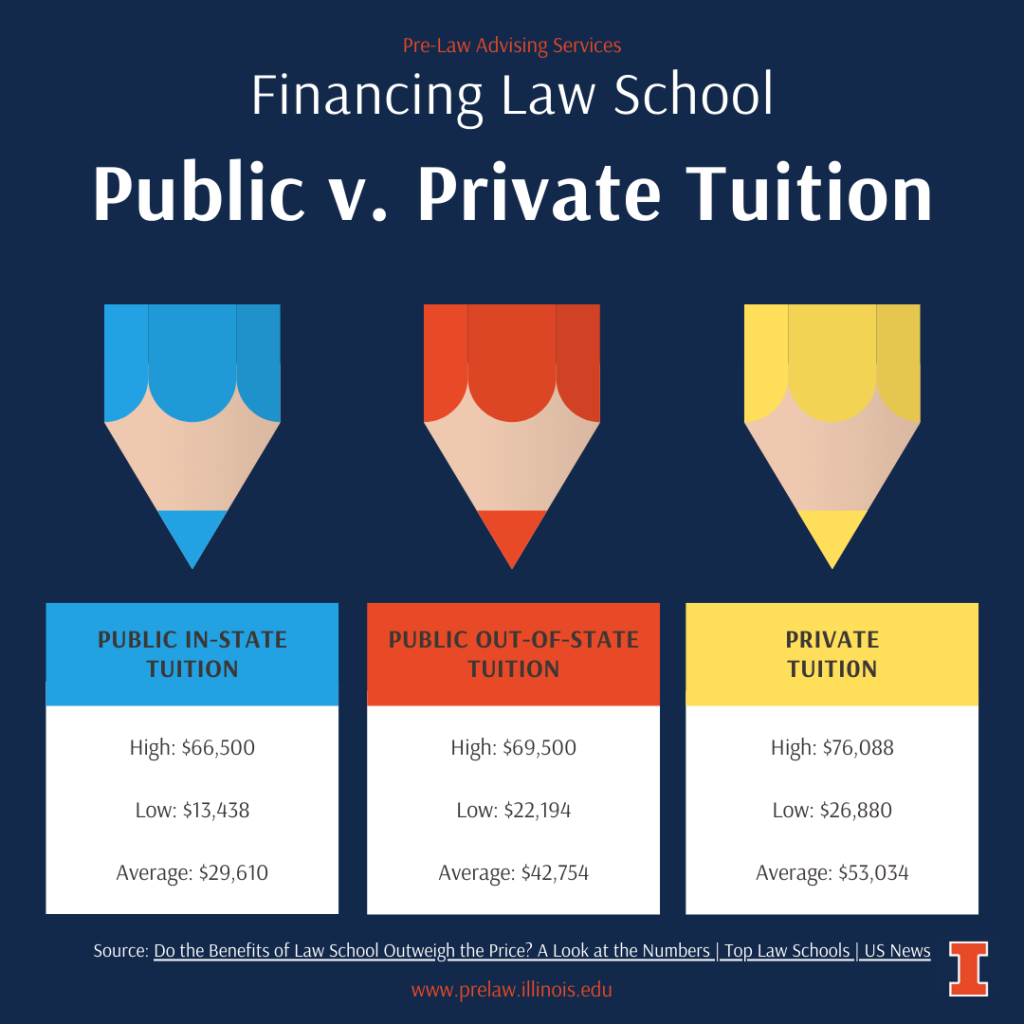

Pay special attention to tuition and cost of living as the price tag will vary significantly based on the type of institution and location. For example, in-state tuition is likely to be more affordable than out-of-state or private tuition. Rent in Champaign-Urbana is likely to be less than rent in Los Angeles or Manhattan.

Consider the images below as visual representations of the variances in cost of living and tuition. Note: exact numbers may vary, for illustrative purposes only.

We hope this overview of how to pay for law school was helpful. Being well informed is one of the best ways to feel confident in your choice of law school and the expenses of pursuing this educational path. If you are ready to begin assessing specific costs, be sure to check out the AccessLex student loan calculator for a clear picture of expenses.

Still have questions?

Pre-Law Advising is here to help! Please come see us. We are more than happy to support you and talk through any questions or concerns!