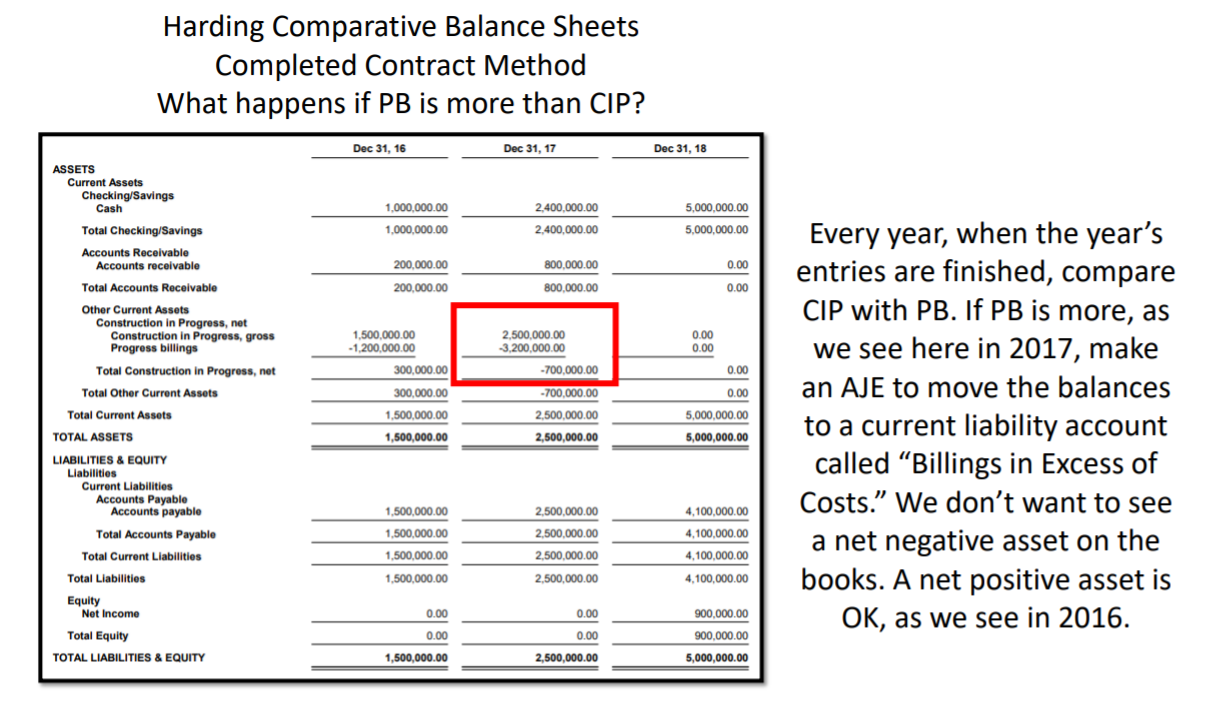

Here is an example of where I did this in the revenue recognition chapter. This is from Part C, where we discussed revenue recognition and long-term contracts. The book does show the balance sheet, but the discussion isn’t very clear to me, and it doesn’t show what the balance sheet looked like immediately before the adjusting journal entry was made. The example below is a really good one of why I like to create the financial statements. It clearly shows how Progress billings is more than Construction in Progress in Year 2. To me, I don’t think the book is clear enough at this particular point in the discussion as to what it looks like and what to do when this happens. Also, the balance sheet shown near the end of the discussion does not match the journal entries shown earlier in the discussion. Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). We don’t know if we should use the liability account until after we compare the balances in PB and CIP. So I agree with the earlier journal entries, and what I created below is based on them. By showing what the balance sheet looks like before the adjusting journal entry is made to the liability account:

- It is very clear that Progress billing is more than Construction in Progress

- Makes it clear what to do, and why, in this case: move the balance to the liability section

I think this balance sheet fills a small, pedagogical gap in the text.