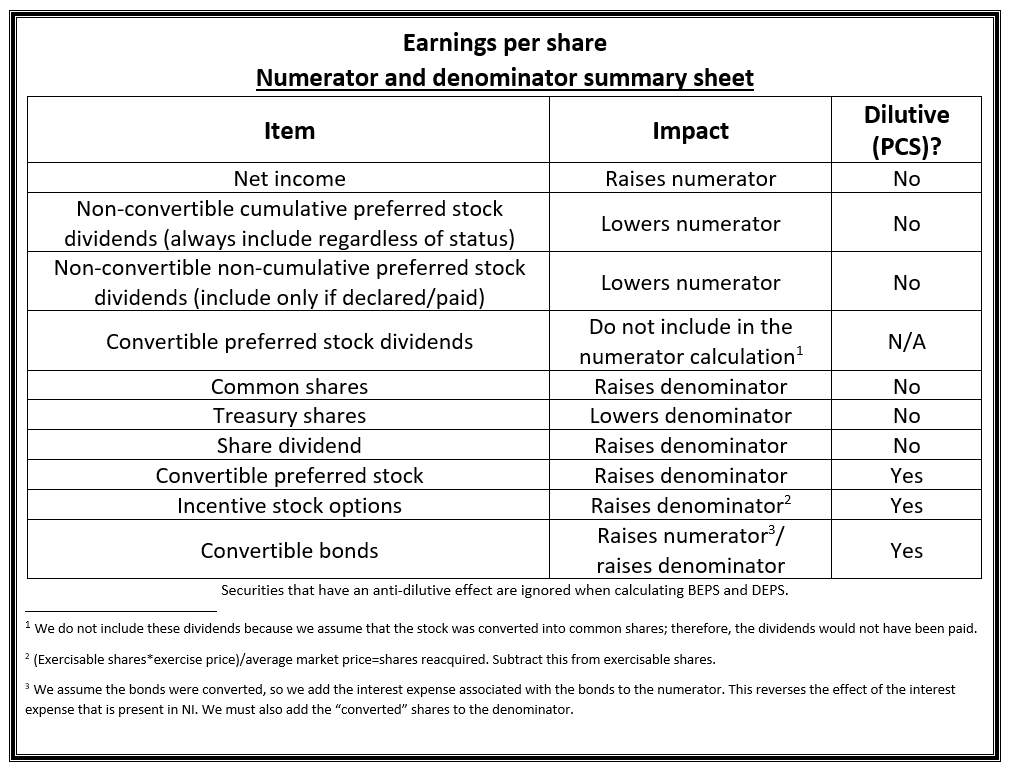

Below is a table I made to summarize what happens to the numerator and denominator for EPS calculations for each kind of relevant transaction. I can see this being helpful for CPA exam preparation, as well as for students of Intermediate Accounting. I include information regarding:

- Net income

- Preferred stock dividends: cumulative and noncumulative, convertible and nonconvertible

- Common shares

- Treasury shares

- Share dividends

- Convertible preferred stock

- Incentive stock options

- Convertible bonds

- Whether the effect is dilutive or not (PCS = potential common shares)

I also included footnotes for elaboration on three of the more complex points.

This is a summary. It does not explain every calculation needed for EPS. It also does not explain how or when to calculate weighted averages for the shares in the denominator.

Here is a PDF of the sheet hosted on Box.