Dynamic Pricing

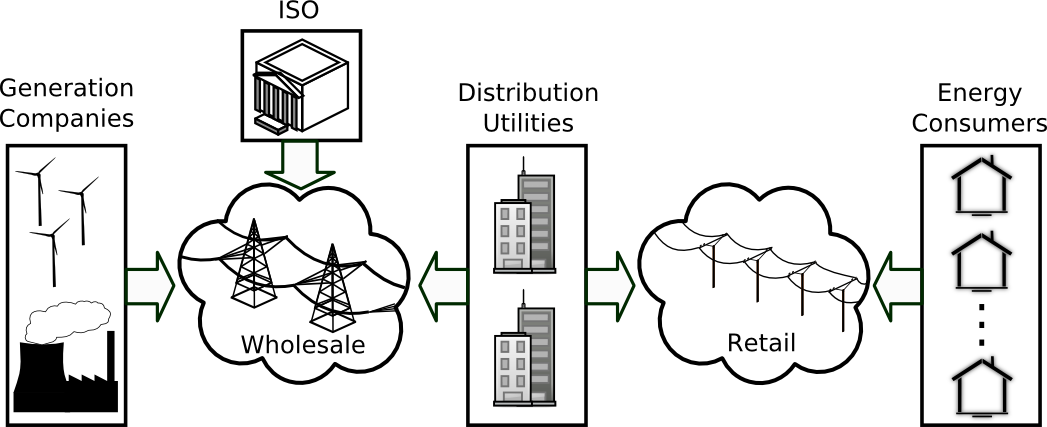

| In restructured electricity markets, the cost of supplying electricity (wholesale) varies throughout the day. In contrast, the prices paid by consumers in the retail market have traditionally been static. For this reason, the demand side of the electricity market has historically been unresponsive, requiring generation to continually adjust to meet demand–sometimes at great cost. Future smart grids are expected to incorporate dynamic pricing for electricity consumers, to improve market efficiency through demand response. |  |

|

Our goal is to design dynamic pricing schemes that are effective and people-centric. That is, consumers should have the incentive to reduce consumption when supply costs are high, but they should also be protected–as much as possible–from higher bills and volatile prices.

ChallengesPerhaps the most efficient dynamic pricing model is real-time pricing (RTP), where retail prices change on an hourly or sub-hourly basis to reflect the true cost of supply in the wholesale market. However, these real-time prices are often volatile, which can harm consumers and may discourage participation in voluntary dynamic pricing programs. Alternative pricing options, such as time-of-use or critical peak pricing, are less desirable from a system standpoint, since price is no longer directly linked with system load. There is a need for new dynamic pricing frameworks, which can mitigate volatility, while allowing prices to vary continuously in response to system operating conditions. |

||

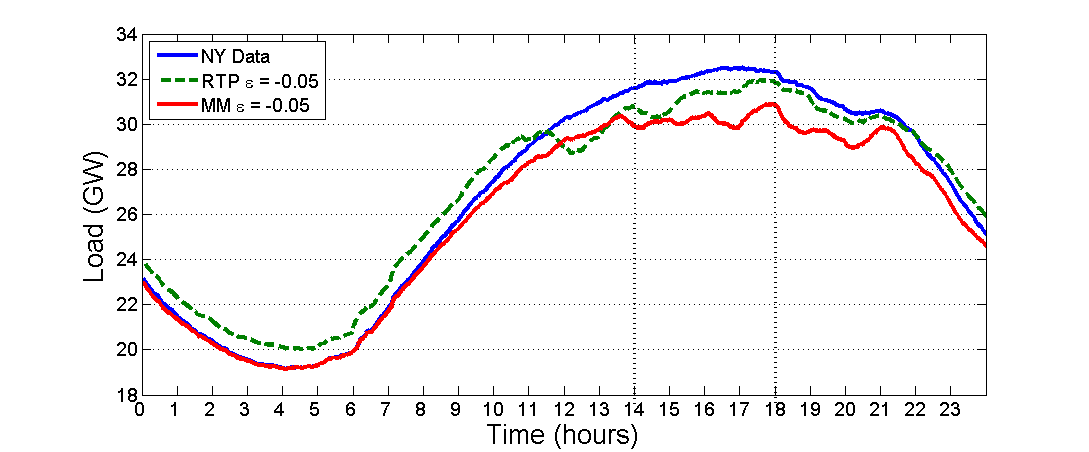

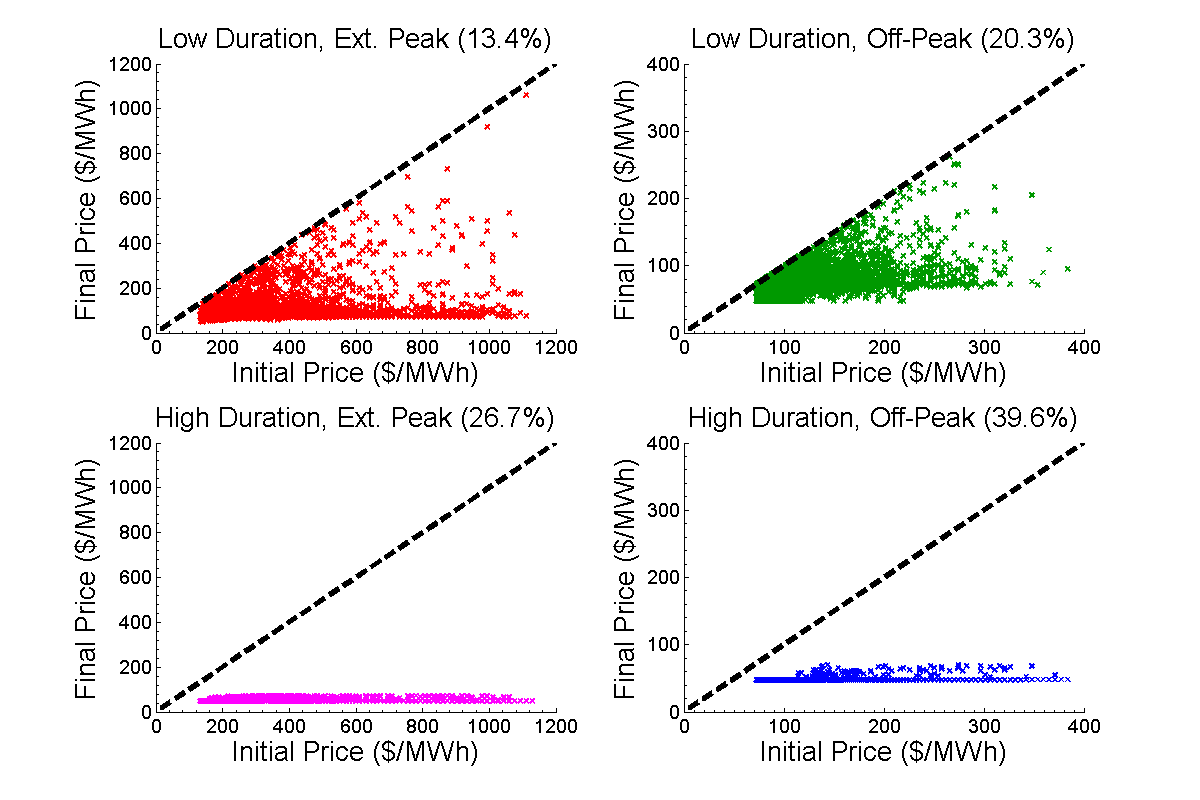

Our approachWe designed a novel dynamic pricing scheme which provides incentives for demand response along with price certainty for consumers who are already using electricity. Monotonic marginal (MM) pricing is based on the marginal cost of supplying electricity, like real-time pricing, encouraging demand response during peak hours. However, by tracking the start and end times of individual user loads, it can ensure that every users’ unit price is non-increasing for a constant consumption level. Our resultsWe used publicly available data from an Independent System Operator (ISO) in the United States to evaluate the demand response performance of an example MM pricing plan versus historical real-time prices under various demand elasticities. The data shown below are from a peak load (i.e., demand) day in 2012. Our simulation results (below, left) show that MM pricing can provide system-level demand response comparable with real-time pricing when the system needs it most. At the same time, our MM pricing scheme ensures that every consumer’s final energy price is lower than her initial price (below, right). Publications

|

||