An Argument for Raising the Cap on Social Security Payroll Tax

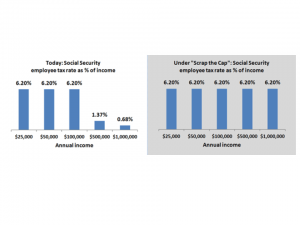

In the United States, Social Security is funded through a dedicated payroll tax. Every employee and their employer are required to contribute 6.2% of earned wages. These wages are capped, however, at just $118,500 a year (SSA, 2015). As a regressive tax, individuals with an income over this cap are required to pay a smaller portion of their income than individuals falling under the cap. Raising the cap gradually over the next 5 years would ensure workers pay their fair share and would reduce Social Security shortcomings.

Introduction to the Problem

Today, someone making $10 million a year contributes the same amount into Social Security as someone making $117,000 (Sanders, 2015). The current social security cap only covers 83% of all earnings; this leaves 17% of taxable income that is currently not being taxed. With the current system, it is projected that future recipients of Social Security will be unable to receive full benefits due to an imbalance of contributors and recipients (U.S. News, 2014). Raising the

cap would correct this imbalance, and simultaneously prevent the working class from further hindrance.

The Facts About Social Security

• Before Social Security was developed, about half of our seniors lived in poverty.

• Today, fewer than 10 percent live in poverty

• Some say we can’t afford to maintain Social Security because of our deficit problem

• In reality, Social Security has not contributed a penny to our deficit because it is a payroll tax, not a program funded by the U.S. Treasury.

• Social Security is facing threats of substantial cuts.

• These cuts and amendments would increase the retirement age, increase taxes on the working class, and ultimately take resources from those who need them most.

• An average 65-year-old currently receives only $16,000 in Social Security benefits; the proposed cuts would decrease her benefits by $1,000 when she reaches 85 (Sanders, 2015).

• There is a fairer and more humane way to make Social Security last.

Call To Action

The economic gap between the rich and the poor has grown exponentially over the last three decades. Raising the cap would ultimately restore fairness to the system. A CEPR analysis of 2011 Census Bureau data found that eliminating the cap would affect the pocketbooks of the top 5.2 percent of wage earners; lifting it to $250,000 would hit 1.3 percent. These affected workers would be 97.5 percent male and 98 percent white (Financial Advisor, 2015).

Virginia Reno, vice president for income security at the National Academy of Social Insurance puts it this way:

“We support Social Security because they hope to get benefits someday, but also because we want to live in a society where everyone has basic security in retirement. High-income people have the ability to pay proportionately, and to live in a society where everyone has basic protection.”

What Can You Do?

In order to raise the cap on Social Security taxes we have to let our voices be heard.

• Lobby your federal government representatives

• Educate yourself and know the facts

• Know the candidates and vote responsibly in upcoming elections

http://www.ontheissues.org/Social_Security.htm

https://www.ssa.gov/planners/maxtax.html

http://money.usnews.com/money/blogs/planning-to-retire/2014/11/14/5-potential-social-security-fixes

http://www.fa-mag.com/news/time-to-raise—-or-scrap—-the-social-security-payroll-cap-17633.html