Congress Day 1

Olivia Mitchell is the International Foundation of Employee Benefit Plans Professor at the Wharton School of the University of Pennsylvania, where she also serves as professor of insurance/risk management and business economics/policy, executive director of the Pension Research Council, and director of the Boettner Center on Pensions and Retirement Research. She serves as a research associate at the National Bureau of Economic Research, independent director on the Wells Fargo Board of Directors, and co-investigator for the health and retirement study at the University of Michigan. Olivia is also a member of the executive board for the Michigan Retirement Research Center and senior research scholar at the Singapore Management University. Additionally, she advises the Centre for Pensions and Superannuation UNSW and is faculty affiliate of the Wharton Public Policy Initiative. Her research interests focus on public and private pensions, insurance and risk management, financial literacy, and public finance. Her research has appeared in leading academic journals, including the American Economic Review, Journal of Political Economy, Journal of Public Economics, and Review of Finance, and has been featured in The Economist, New York Times, and Wall Street Journal. She has published over 250 books and articles, contributes as a blogger for Forbes, and serves as a senior editor of the Journal of Pension Economics and Finance. She has received numerous professional awards and honors, including the Fidelity Pyramid Prize for research improving lifelong financial well-being, the Carolyn Shaw Bell Award of the Committee on the Status of Women in the Economics Profession, and the Roger F. Murray First Prize (twice) from the Institute for Quantitative Research in Finance.

Professor at the Wharton School of the University of Pennsylvania, where she also serves as professor of insurance/risk management and business economics/policy, executive director of the Pension Research Council, and director of the Boettner Center on Pensions and Retirement Research. She serves as a research associate at the National Bureau of Economic Research, independent director on the Wells Fargo Board of Directors, and co-investigator for the health and retirement study at the University of Michigan. Olivia is also a member of the executive board for the Michigan Retirement Research Center and senior research scholar at the Singapore Management University. Additionally, she advises the Centre for Pensions and Superannuation UNSW and is faculty affiliate of the Wharton Public Policy Initiative. Her research interests focus on public and private pensions, insurance and risk management, financial literacy, and public finance. Her research has appeared in leading academic journals, including the American Economic Review, Journal of Political Economy, Journal of Public Economics, and Review of Finance, and has been featured in The Economist, New York Times, and Wall Street Journal. She has published over 250 books and articles, contributes as a blogger for Forbes, and serves as a senior editor of the Journal of Pension Economics and Finance. She has received numerous professional awards and honors, including the Fidelity Pyramid Prize for research improving lifelong financial well-being, the Carolyn Shaw Bell Award of the Committee on the Status of Women in the Economics Profession, and the Roger F. Murray First Prize (twice) from the Institute for Quantitative Research in Finance.

Congress Day 2

Ruodu Wang is an associate professor in actuarial science and quantitative finance and a university research chair at the University of Waterloo in Canada. He holds editorial positions in leading journals in actuarial science and mathematical economics, including serving as co-editor of the European Actuarial Journal and of the ASTIN Bulletin – The Journal of the International Actuarial Association. His scientific work has appeared in academic journals in various other fields, such as Management Science, Operations Research, The Annals of Statistics, Biometrika, The Annals of Applied Probability, Mathematics of Operations Research, Mathematical Finance, Finance & Stochastics, and Journal of Banking & Finance. He is an affiliated member of RiskLab at ETH Zurich. He received the Golden Jubilee Research Excellence Award from the Faculty of Mathematics at Waterloo in 2017 and a Discovery Accelerator Supplement Award from the Natural Sciences and Engineering Research Council in 2018.

finance and a university research chair at the University of Waterloo in Canada. He holds editorial positions in leading journals in actuarial science and mathematical economics, including serving as co-editor of the European Actuarial Journal and of the ASTIN Bulletin – The Journal of the International Actuarial Association. His scientific work has appeared in academic journals in various other fields, such as Management Science, Operations Research, The Annals of Statistics, Biometrika, The Annals of Applied Probability, Mathematics of Operations Research, Mathematical Finance, Finance & Stochastics, and Journal of Banking & Finance. He is an affiliated member of RiskLab at ETH Zurich. He received the Golden Jubilee Research Excellence Award from the Faculty of Mathematics at Waterloo in 2017 and a Discovery Accelerator Supplement Award from the Natural Sciences and Engineering Research Council in 2018.

Congress Day 3

Michel Denuit is a professor of probability, statistics and actuarial mathematics at the UCLouvain in Belgium. He was co-editor of the ASTIN Bulletin – The Journal of the International Actuarial Association and founding editor of the Belgian Actuarial Bulletin, which is now included in the European Actuarial Journal. Well-known in the research community, he has a wide range of research expertise in actuarial science, applied probability, statistics, mathematical economics, and operations research. He has been published in Insurance: Mathematics and Economics, The Journal of Risk and Insurance, Journal of Economic Theory, Management Science, Mathematics of Operations Research, and Annals of Applied Probability. His recent work on peer-to-peer insurance and recent book series on machine learning and predictive analytics are appealing to lots of young scholars. He has been recognized with numerous prizes and honors, including ARIA’s Brockett-Shapiro Actuarial Journal Award 2019 and Harris Schlesinger Prize for Research Excellence 2019.

mathematics at the UCLouvain in Belgium. He was co-editor of the ASTIN Bulletin – The Journal of the International Actuarial Association and founding editor of the Belgian Actuarial Bulletin, which is now included in the European Actuarial Journal. Well-known in the research community, he has a wide range of research expertise in actuarial science, applied probability, statistics, mathematical economics, and operations research. He has been published in Insurance: Mathematics and Economics, The Journal of Risk and Insurance, Journal of Economic Theory, Management Science, Mathematics of Operations Research, and Annals of Applied Probability. His recent work on peer-to-peer insurance and recent book series on machine learning and predictive analytics are appealing to lots of young scholars. He has been recognized with numerous prizes and honors, including ARIA’s Brockett-Shapiro Actuarial Journal Award 2019 and Harris Schlesinger Prize for Research Excellence 2019.

Christian Robert is a professor of statistics and actuarial sciences at ENSAE Paris in France and research fellow at the Laboratory in Finance and Insurance (LFA) CREST, Center for Research in Economics and Statistics. He has been associate editor for Quantitative Finance and European Actuarial Journal since 2017. His research interests include extreme value theory and statistics, actuarial theory and practice, statistical finance, and statistical learning. He publishes in Stochastic Processes and Their Applications, The Annals of Applied Probability, Biometrika, Mathematical Finance, and The Annals of Statistics.

Paris in France and research fellow at the Laboratory in Finance and Insurance (LFA) CREST, Center for Research in Economics and Statistics. He has been associate editor for Quantitative Finance and European Actuarial Journal since 2017. His research interests include extreme value theory and statistics, actuarial theory and practice, statistical finance, and statistical learning. He publishes in Stochastic Processes and Their Applications, The Annals of Applied Probability, Biometrika, Mathematical Finance, and The Annals of Statistics.

Congress Day 4

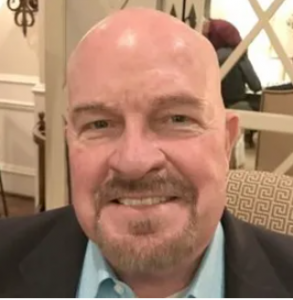

Patrick Brockett is the Gus S. Wortham Memorial Chair in Risk Management and Insurance at the University of Texas at Austin, where he also serves as a professor with joint appointments in the Departments of Information, Risk and Operations Management, Finance, and Mathematics, director of the Risk Management and Insurance Program, director of the Center for Risk Management and Insurance, and global research fellow at the IC2 Institute. He is editor-in-chief of the North American Actuarial Journal. Previously, he served as editor of the Journal of Risk and Insurance and president of the American Risk and Insurance Association (ARIA). His research interests include insurance, risk theory, risk management, statistics, actuarial science, data envelopment analysis, and quantitative models in business. Brockett has published in the Journal of Risk and Insurance, European Journal of Operational Research, The Annals of Statistics, The Annals of Probability, Journal of the American Statistical Association, and Management Science. He has received numerous accolades for his professional achievements, including a recently endowed and named ARIA research award, The Patrick Brockett & Arnold Shapiro Actuarial Research Award.

and Insurance at the University of Texas at Austin, where he also serves as a professor with joint appointments in the Departments of Information, Risk and Operations Management, Finance, and Mathematics, director of the Risk Management and Insurance Program, director of the Center for Risk Management and Insurance, and global research fellow at the IC2 Institute. He is editor-in-chief of the North American Actuarial Journal. Previously, he served as editor of the Journal of Risk and Insurance and president of the American Risk and Insurance Association (ARIA). His research interests include insurance, risk theory, risk management, statistics, actuarial science, data envelopment analysis, and quantitative models in business. Brockett has published in the Journal of Risk and Insurance, European Journal of Operational Research, The Annals of Statistics, The Annals of Probability, Journal of the American Statistical Association, and Management Science. He has received numerous accolades for his professional achievements, including a recently endowed and named ARIA research award, The Patrick Brockett & Arnold Shapiro Actuarial Research Award.

Congress Day 5

Robert Jarrow is the Ronald P. & Susan E. Lynch Professor of Investment Management and a professor of finance at the Johnson Graduate School of Management in Cornell University. Robert co-created the journal Mathematical Finance, and he serves as an advisory or associate editor for numerous other finance journals. Robert is currently engaged in research relating to asset pricing, liquidity risk, price bubbles, and risk management. He co-created the Heath–Jarrow–Morton model and the reduced form credit risk model, both of which are the standard models used by financial institutions and central banks around the world today. He was the first to distinguish forward/futures prices and to study market manipulation using arbitrage-pricing theory. His research has appeared in leading academic journals, including The Journal of Finance, The Review of Financial Studies, and Journal of Financial Economics. His research has won numerous awards, including the Graham and Dodd Scrolls Award 2001, the CBOE Pomerance Prize in 1982, and the Ross Best Paper Award in 2008. In 1997, he was named International Association of Financial Engineers (IAFE, today known as IAQF, International Association of Quantitative Finance) Financial Engineer of the Year in recognition of his research accomplishments. He is currently an IAQF senior fellow, and serves on various corporate boards of directors and advisory boards. Robert has been inducted into the Fixed Income Analysts Society Hall of Fame and Risk Magazine‘s 50 member Hall of Fame, and is listed in the Who’s Who of Economics. He received Risk Magazine‘s Lifetime Achievement Award in 2009.

Management and a professor of finance at the Johnson Graduate School of Management in Cornell University. Robert co-created the journal Mathematical Finance, and he serves as an advisory or associate editor for numerous other finance journals. Robert is currently engaged in research relating to asset pricing, liquidity risk, price bubbles, and risk management. He co-created the Heath–Jarrow–Morton model and the reduced form credit risk model, both of which are the standard models used by financial institutions and central banks around the world today. He was the first to distinguish forward/futures prices and to study market manipulation using arbitrage-pricing theory. His research has appeared in leading academic journals, including The Journal of Finance, The Review of Financial Studies, and Journal of Financial Economics. His research has won numerous awards, including the Graham and Dodd Scrolls Award 2001, the CBOE Pomerance Prize in 1982, and the Ross Best Paper Award in 2008. In 1997, he was named International Association of Financial Engineers (IAFE, today known as IAQF, International Association of Quantitative Finance) Financial Engineer of the Year in recognition of his research accomplishments. He is currently an IAQF senior fellow, and serves on various corporate boards of directors and advisory boards. Robert has been inducted into the Fixed Income Analysts Society Hall of Fame and Risk Magazine‘s 50 member Hall of Fame, and is listed in the Who’s Who of Economics. He received Risk Magazine‘s Lifetime Achievement Award in 2009.